2022 tax brackets

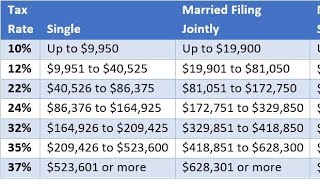

2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Taxable income up to 10275.

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

The federal income tax rates for 2022 did not change from 2021.

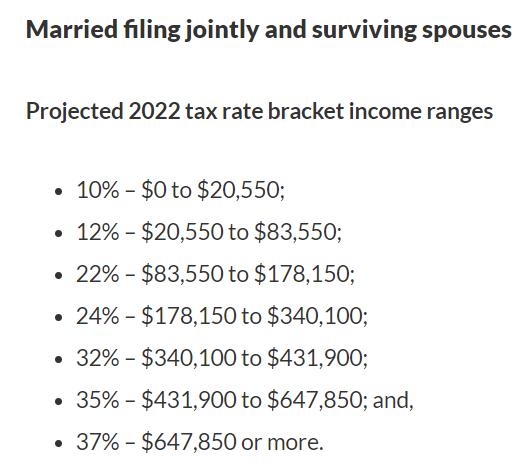

. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Trending News IRS sets its new tax brackets. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

2022 tax brackets are here. Up from 25900 in 2022. The other rates are.

Taxable income between 10275 to 41775. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550. Taxable income between 89075 to 170050.

Whether you are single a head of household married etc. 10 12 22 24 32 35 and 37 depending on the tax bracket. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71.

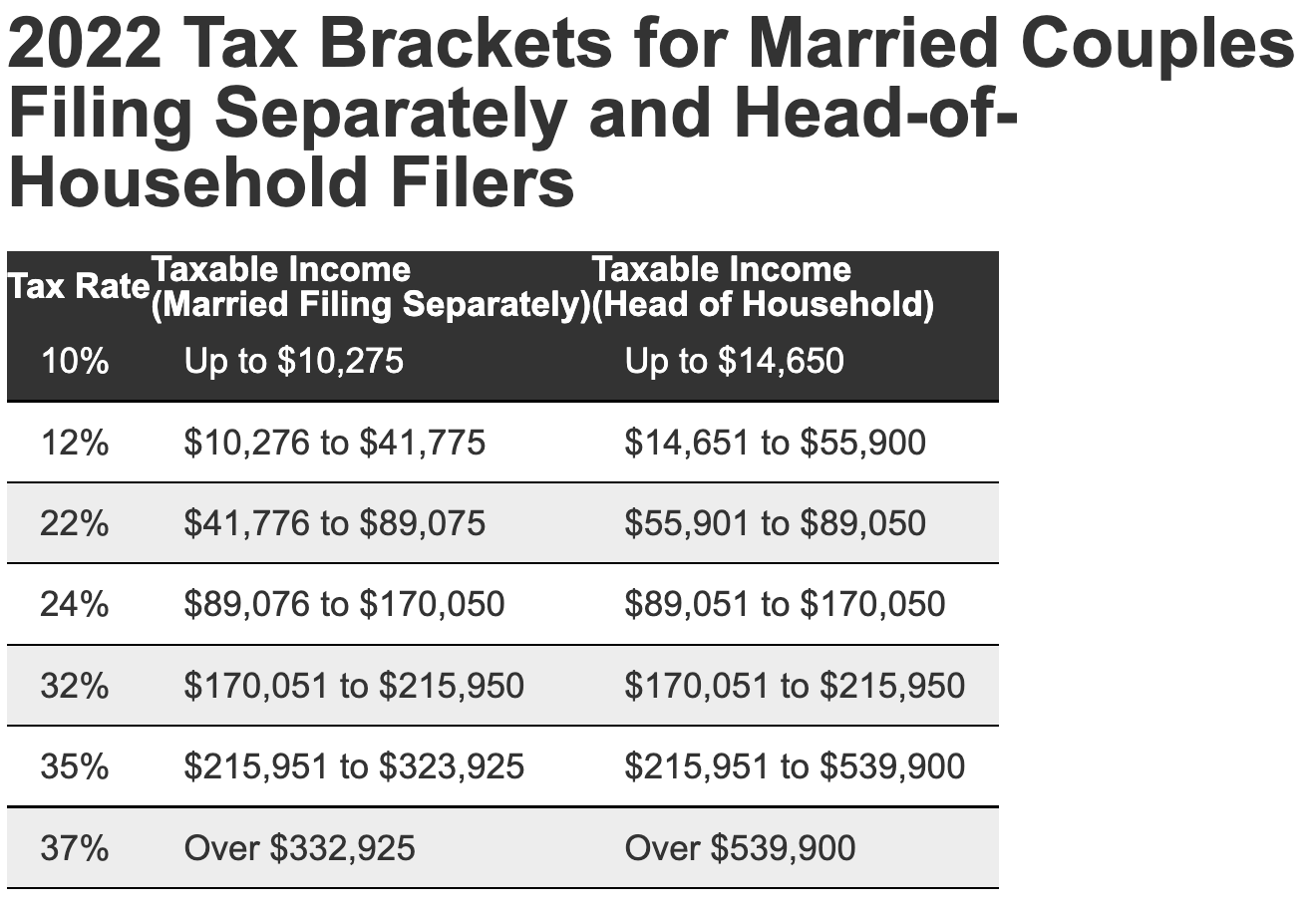

13 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. 35 for incomes over 215950 431900 for married couples filing jointly. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household.

There are seven federal income tax rates in 2022. Taxable income between 41775 to 89075. Single filers may claim.

Heres what filers need to know. Download the free 2022 tax bracket pdf. 17 hours agoThe IRS has released higher federal tax brackets and standard deductions for 2023 to adjust for inflation.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

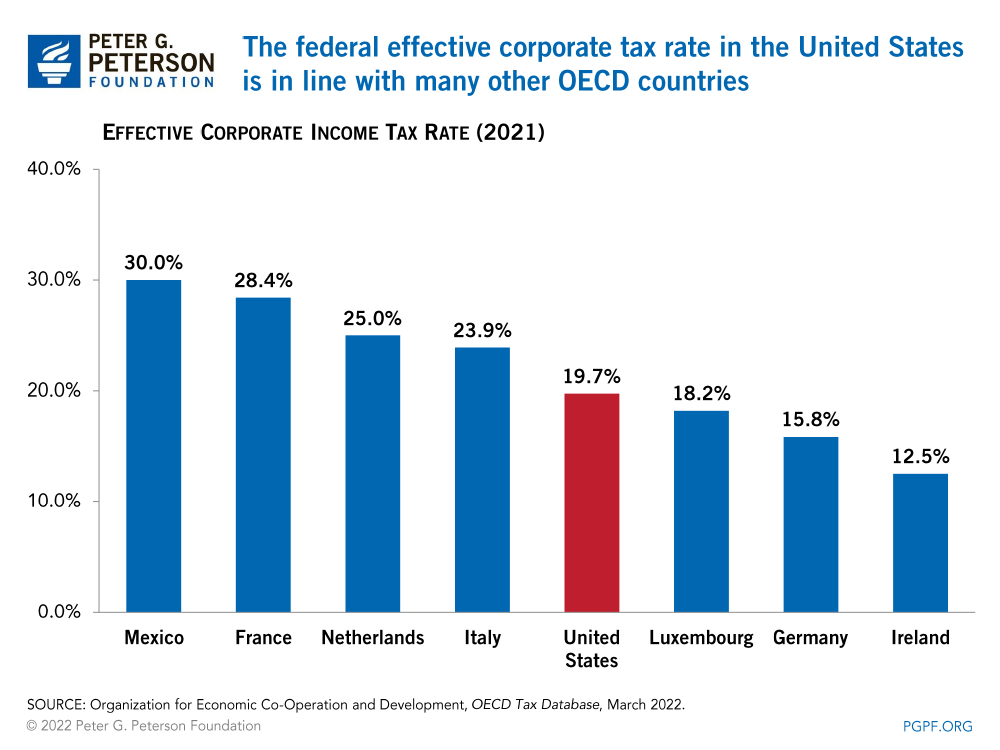

What Is The Difference Between The Statutory And Effective Tax Rate

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

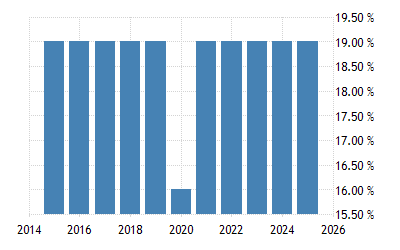

Germany Corporate Tax Rate 2022 Take Profit Org

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Germany Sales Tax Rate Vat 2022 Data 2023 Forecast 2000 2021 Historical

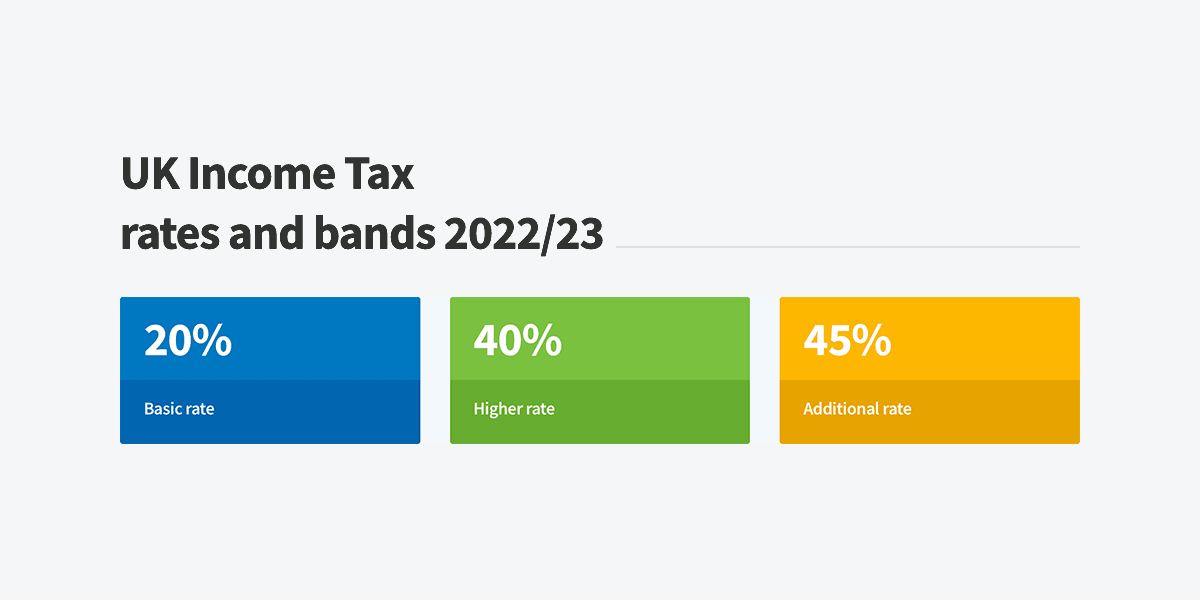

Uk Income Tax Rates And Bands 2022 23 Freeagent

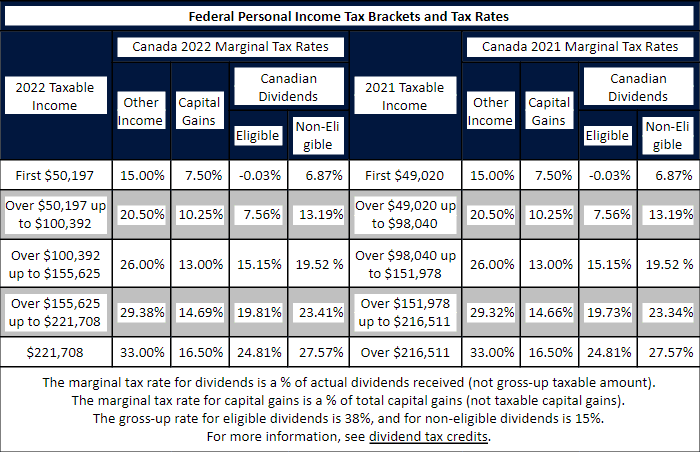

Tax Brackets Canada 2022 Filing Taxes

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Tax Brackets For 2021 And 2022 Ameriprise Financial

Nyc Property Tax Rates For 2021 2022 Rosenberg Estis P C

2022 2023 Tax Brackets Rates For Each Income Level

2022 Income Tax Brackets And The New Ideal Income

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

What Are The Income Tax Brackets For 2022 Vs 2021